Mastering Job Costing with QuickBooks Online: A Comprehensive Guide

Related Articles: Mastering Job Costing with QuickBooks Online: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Mastering Job Costing with QuickBooks Online: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Mastering Job Costing with QuickBooks Online: A Comprehensive Guide

In the realm of business management, accurate and efficient cost tracking is paramount. For businesses operating in industries that involve projects, contracts, or services, understanding the true cost of each job is essential for profitability and informed decision-making. This is where job costing comes into play, providing a structured system for tracking expenses, labor, and materials associated with specific projects.

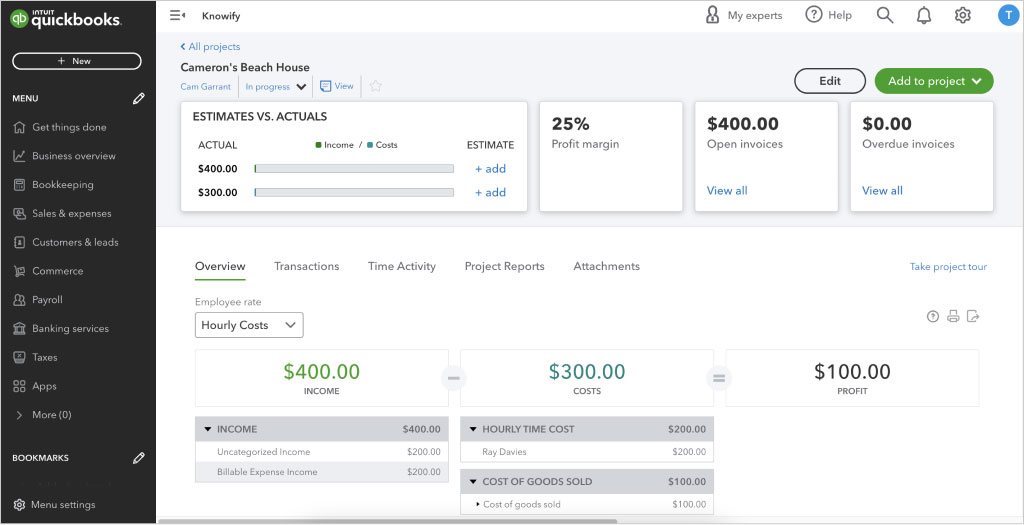

QuickBooks Online Job Costing: A Powerful Tool for Project-Based Businesses

QuickBooks Online, a popular cloud-based accounting software, offers a robust job costing feature designed to streamline the process of tracking project expenses and profitability. This feature allows businesses to gain granular insights into the financial health of individual projects, leading to better budgeting, pricing strategies, and overall business management.

Understanding the Fundamentals of Job Costing

Before delving into the specifics of QuickBooks Online job costing, it’s crucial to grasp the fundamental concepts:

- Job Costing: This accounting method involves allocating costs to specific projects or jobs. It allows businesses to track expenses related to labor, materials, overhead, and other project-specific costs.

- Direct Costs: These are expenses directly linked to a specific job, such as materials used or labor hours spent on a project.

- Indirect Costs: These are expenses not directly tied to a specific job but are necessary for the business’s overall operation. Examples include rent, utilities, and administrative salaries.

- Overhead: This represents the indirect costs associated with running a business. It is often allocated to specific jobs based on a predetermined method, such as labor hours or material costs.

QuickBooks Online Job Costing: A Step-by-Step Guide

Let’s explore the key steps involved in utilizing QuickBooks Online’s job costing feature:

- Setting Up Job Costing: The first step is to activate the job costing feature in QuickBooks Online. This involves creating job categories and defining the specific cost elements that will be tracked for each job.

- Creating Jobs: Once job costing is enabled, you can create individual jobs within the system. Each job should have a unique name, description, and a designated job category.

- Tracking Job Expenses: As you incur expenses related to a specific job, you can record them within the system. This includes direct costs like materials, labor, and subcontractors, as well as indirect costs allocated to the job.

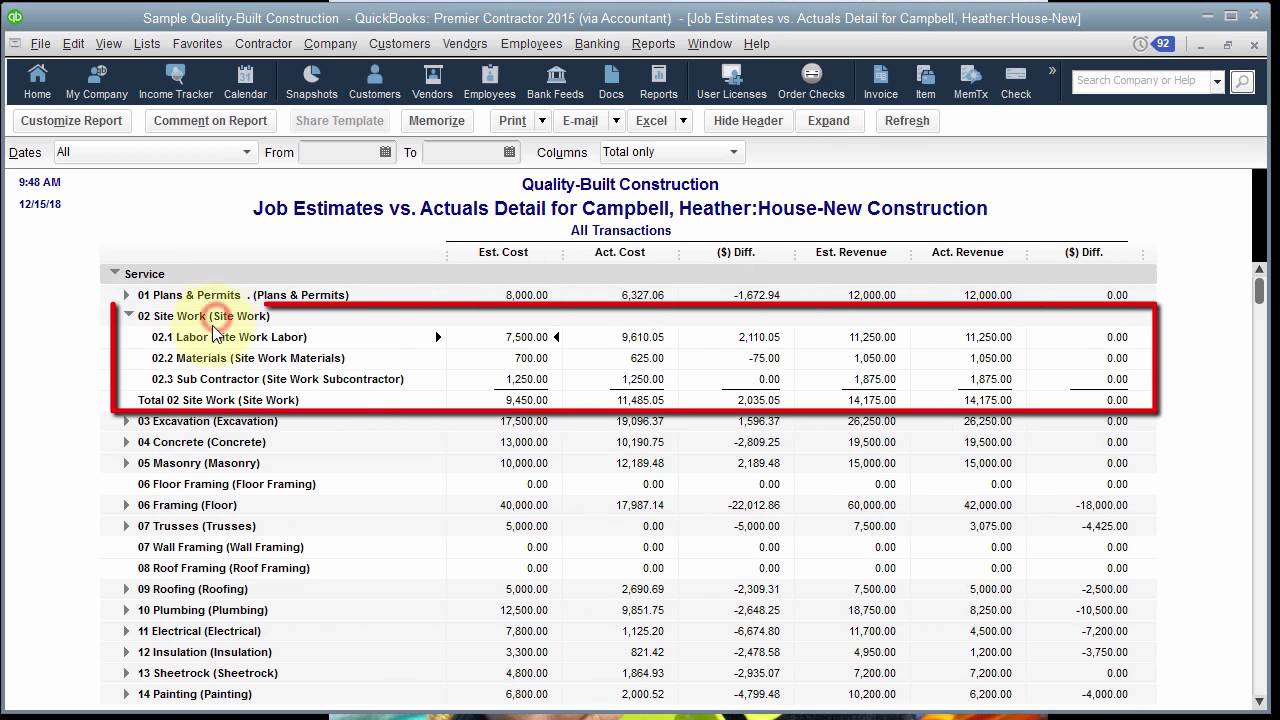

- Generating Reports: QuickBooks Online provides a range of reports that offer detailed insights into job profitability. These reports can showcase the cost of each job, its profitability, and other relevant financial metrics.

Key Benefits of Utilizing QuickBooks Online Job Costing

- Enhanced Profitability: By accurately tracking job costs, businesses can identify profitable and unprofitable projects, allowing them to optimize pricing strategies and maximize profitability.

- Improved Budgeting: Job costing provides a clear picture of project expenses, facilitating more accurate budget forecasting and financial planning.

- Better Decision-Making: With detailed cost information at their fingertips, businesses can make informed decisions regarding project selection, resource allocation, and pricing.

- Streamlined Operations: The automated tracking and reporting features of QuickBooks Online job costing streamline the process of managing project costs, reducing the risk of errors and saving valuable time.

- Increased Transparency: Job costing promotes transparency within the organization, allowing team members and stakeholders to understand the financial performance of individual projects.

FAQs on QuickBooks Online Job Costing

Q: What types of businesses benefit most from QuickBooks Online job costing?

A: Businesses operating in project-based industries, such as construction, engineering, consulting, and services, stand to gain the most from QuickBooks Online job costing.

Q: How does QuickBooks Online allocate indirect costs to jobs?

A: QuickBooks Online allows you to choose from various allocation methods, such as labor hours, material costs, or a fixed percentage.

Q: Can I use QuickBooks Online job costing for multiple projects simultaneously?

A: Yes, QuickBooks Online job costing allows you to track costs for multiple projects concurrently, providing a comprehensive view of your project portfolio.

Q: How does QuickBooks Online job costing help with tax preparation?

A: QuickBooks Online job costing provides detailed cost breakdowns, simplifying the process of preparing tax returns and ensuring accurate reporting.

Tips for Effective Job Costing in QuickBooks Online

- Establish Clear Job Categories: Define specific job categories that accurately reflect your business operations.

- Use Detailed Descriptions: When creating jobs, provide comprehensive descriptions to ensure clarity and avoid confusion.

- Regularly Review and Update Job Costs: Stay on top of your job costs by regularly reviewing and updating expense entries.

- Utilize Job Costing Reports: Leverage the reporting features of QuickBooks Online to gain insights into job profitability and make informed decisions.

- Seek Professional Guidance: If you require assistance with setting up or utilizing QuickBooks Online job costing, consider consulting with a qualified accounting professional.

Conclusion

QuickBooks Online job costing is a powerful tool that empowers businesses in project-based industries to gain control over their costs, improve profitability, and make informed decisions. By embracing the features of this software, businesses can streamline their project management processes, enhance financial transparency, and achieve greater success.

Closure

Thus, we hope this article has provided valuable insights into Mastering Job Costing with QuickBooks Online: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!