Navigating The Decision: Should You Withdraw Your Provident Fund After Quitting Your Job?

Navigating the Decision: Should You Withdraw Your Provident Fund After Quitting Your Job?

Related Articles: Navigating the Decision: Should You Withdraw Your Provident Fund After Quitting Your Job?

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Decision: Should You Withdraw Your Provident Fund After Quitting Your Job?. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Decision: Should You Withdraw Your Provident Fund After Quitting Your Job?

Leaving a job often brings a mix of emotions: relief, excitement, and a touch of uncertainty. Amidst these feelings, a crucial decision arises – what to do with your Provident Fund (PF) savings? This article delves into the complexities of this choice, examining the factors that influence the decision and providing a framework for making an informed choice.

Understanding the Provident Fund: A Retirement Nest Egg

The Provident Fund is a retirement savings scheme, mandated by the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952. It operates as a compulsory savings program, with contributions from both the employee and employer. The fund grows through interest earned on the accumulated corpus, providing a safety net for post-retirement years.

The Dilemma: When Should You Withdraw Your PF?

The decision to withdraw your PF after quitting a job is not a simple yes or no. It hinges on a multitude of factors, including your immediate financial needs, long-term financial goals, and the nature of your next employment.

Factors to Consider Before Withdrawing Your PF:

- Immediate Financial Needs: If you find yourself in a tight spot financially, the PF withdrawal can provide a much-needed cash injection. This could be for covering essential expenses, settling debts, or funding a new venture. However, it’s crucial to remember that this is a long-term savings scheme, and tapping into it prematurely can impact your future financial security.

- Future Employment Prospects: If you are certain of securing a new job quickly, withdrawing your PF may not be necessary. The new employer will continue contributing to your PF account, allowing your savings to grow. However, if job prospects are uncertain, withdrawing your PF might provide a financial cushion during the transition.

- Long-Term Financial Goals: Your long-term financial goals play a pivotal role in the decision. If you are aiming for early retirement, investing in a property, or funding your child’s education, maintaining the PF corpus is crucial. Withdrawing the funds could disrupt these plans.

- Tax Implications: Withdrawing your PF before retirement is usually subject to tax. The withdrawal amount is taxed at your applicable income tax slab. Understanding the tax implications will help you factor in the actual net benefit of withdrawal.

- Investment Opportunities: The PF scheme offers a guaranteed return, though it might not be the most lucrative investment option. If you have a higher risk appetite and are seeking better returns, withdrawing the PF and investing elsewhere might be a viable option. However, carefully evaluate the risks involved before making such a decision.

Alternatives to Immediate Withdrawal:

- Partial Withdrawal: The EPF scheme allows partial withdrawals for specific purposes, such as marriage, house construction, or education. This option allows you to access a portion of your savings without completely depleting the corpus.

- PF Transfer: If you are switching jobs, you can transfer your PF account to your new employer’s scheme. This preserves your savings and ensures continued growth.

- PF Loan: The EPF scheme allows members to avail of loans against their PF contributions. This option provides a temporary financial solution without having to withdraw the entire corpus.

FAQs: Addressing Common Concerns

1. What happens to my PF if I do not withdraw it?

If you don’t withdraw your PF, it will continue to accumulate and earn interest. Upon retirement, you can withdraw the entire amount, along with the accrued interest, to supplement your retirement income.

2. Can I withdraw my PF before completing 5 years of service?

Yes, you can withdraw your PF before completing 5 years of service, but it is subject to certain conditions. You can withdraw your contributions, but the employer’s contribution and interest earned will be forfeited.

3. What are the tax implications of withdrawing my PF?

The withdrawal amount is taxed at your applicable income tax slab. However, if you withdraw the PF after completing 5 years of service, the first Rs. 3.5 lakh of withdrawal is tax-free under Section 80C of the Income Tax Act.

4. Can I withdraw my PF if I am unemployed?

Yes, you can withdraw your PF even if you are unemployed. However, it is advisable to explore other options, like transferring your PF to a new employer, if you are seeking new employment.

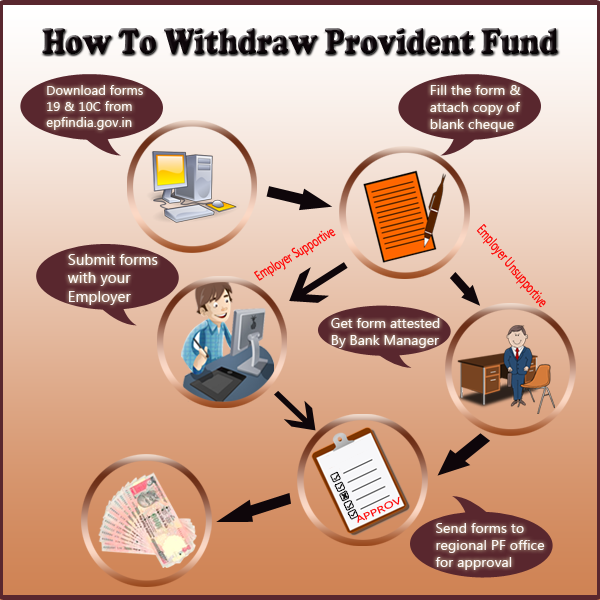

5. What are the documents required for PF withdrawal?

The required documents vary depending on the reason for withdrawal. However, generally, you will need your PF account details, your Aadhaar card, and your bank account details.

Tips for Making an Informed Decision:

- Seek Financial Advice: Consult a financial advisor to understand your specific financial situation and the best course of action.

- Assess Your Needs: Analyze your immediate and long-term financial needs to determine if withdrawing your PF is truly necessary.

- Consider Alternatives: Explore alternative options like partial withdrawal, PF transfer, or PF loan before making a decision.

- Weigh the Pros and Cons: Carefully weigh the benefits and drawbacks of withdrawing your PF to make an informed choice.

- Document Your Decision: Keep a record of your decision-making process, including the factors considered and the reasons for your choice.

Conclusion: A Balanced Approach to PF Withdrawal

The decision to withdraw your PF after quitting a job is a personal one, with no single right or wrong answer. It requires careful consideration of your individual circumstances, financial goals, and future prospects. By understanding the factors involved, exploring alternatives, and seeking professional advice, you can navigate this decision with confidence, ensuring that your financial well-being is protected. Remember, your PF is a valuable asset built over time, and its management should align with your long-term financial security.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Decision: Should You Withdraw Your Provident Fund After Quitting Your Job?. We appreciate your attention to our article. See you in our next article!